Dear Fellow Shareholders,

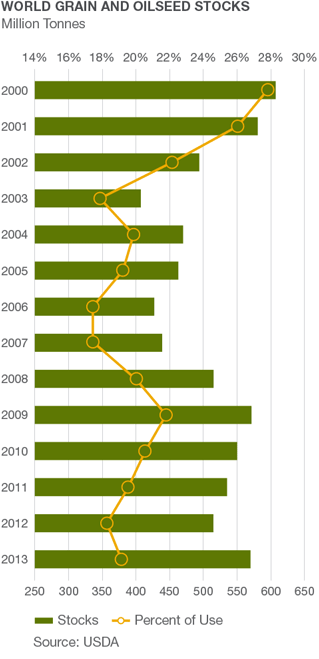

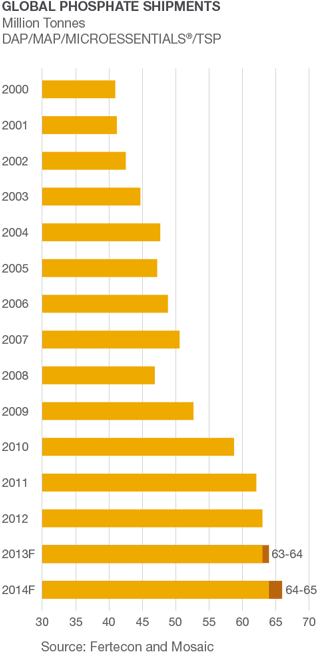

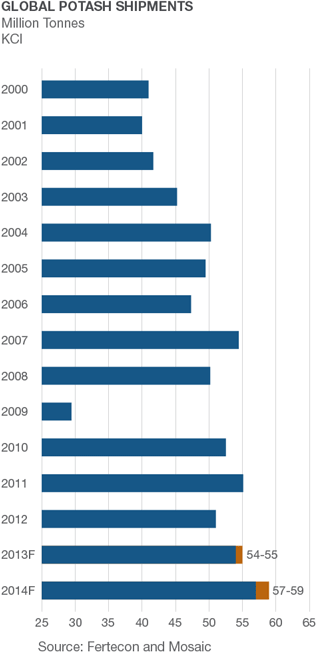

2013 set up a number of challenges for the crop nutrition industry, and for Mosaic. Market prices for potash and phosphates declined through most of the year in response to wide-ranging economic and governmental influences: New supplies came to market, from Mosaic and our competitors; and crop nutrient demand softened in key agricultural centers, driven largely by lower grain and oilseed prices and policy changes in India.

The easy response to such difficult operating conditions would be to hunker down and wait for better times. But at Mosaic, we seized opportunities and pushed our growth strategy forward. We choose to view the tough environment as a climate for growth.

The crop nutrition industry — indeed, the broad industry of agriculture — has always been cyclical. Mosaic’s seasoned management team has weathered many troughs and peaks, and we have positioned Mosaic to thrive through these cycles, because we know that the long-term outlook for global food and, in turn, plant nutrient demand is extremely appealing.

We seized opportunities and pushed our growth strategy forward. We choose to view the tough environment as a climate for growth.

A Year of Major Momentum

Many market factors are outside our control, so we chose to focus on what we can control and on executing Mosaic’s clearly defined strategy. We made huge progress in this regard in 2013, and, as a result, Mosaic is positioned to emerge, in a stronger business environment, as the world’s leading crop nutrition company.

- We acquired CF Industries’ Central Florida-based phosphate business for a total of $1.4 billion in cash. The deal was announced in October and was completed in March 2014. The additional 1.8 million tonnes of phosphate capacity will bring our capacity to approximately 11.5 million tonnes — extending Mosaic’s lead as the largest finished phosphate producer in the world. The acquisition provides many benefits for Mosaic, including enhanced operating efficiencies, lower production costs and reduced capital investment.

- We reached ammonia supply agreements with CF Industries. Together with our existing ammonia production capacity in Louisiana, the agreements assure us that the vast majority of our ammonia needs will be satisfied at attractive terms for many years to come. In light of these agreements, Mosaic was able to forego construction of an ammonia manufacturing plant — saving approximately $1 billion in capital investment.

- Earlier in 2013, we entered into an agreement to develop a 3.5 million-tonne integrated phosphate mine and granulation operation with Ma’aden and SABIC in the Kingdom of Saudi Arabia. Mosaic owns 25 percent of the joint venture and will market a similar percentage of its production. The low-cost operations promise to diversify our sources of phosphates and facilitate improved logistical access to key agricultural countries, including India. Planning for the facilities is proceeding on schedule, and construction is underway.

- Also in phosphates, we made good progress in our Central Florida mine permitting process.

- Our potash expansions continued on budget and on schedule, despite a rising cost environment in Saskatchewan and challenging conditions in the global potash market. Our Esterhazy K3 mineshaft is moving forward, and we expect to reach the potash seam in 2015. In the second half of 2013, we conducted an extremely successful proving run to demonstrate the Esterhazy mine's capacity and increased our share of Canpotex Limited sales.

- Mosaic extended its product innovation lead. For the first year ever, we delivered more than 1 million tonnes of MicroEssentials®, our phosphate-based premium micronutrient, to customers in North America, and shipped a growing volume of MicroEssentials to customers in other regions, most notably South America. In addition, in early 2014 we launched Aspire™, a field-proven potash-based premium product.

- We made difficult decisions to exit our distribution business in Argentina and Chile, and to decommission our small potash mine in Hersey, Michigan. Those elements of our business simply were not generating appropriate returns for our shareholders.

- We dissolved PhosChem, the former phosphate marketing consortium. With only two remaining members — from a high of 15 — and with Mosaic representing over 90 percent of PhosChem’s product volume, the association no longer served the purpose of an export association.

-

We began to put our industry-leading financial strength to work, through several important strategic financial moves.

We issued $2 billion of long-term debt at a very low average interest rate of approximately 5 percent. The offering was met with strong investor enthusiasm.

We reached an agreement to repurchase 43.3 million shares of Class A stock from the Margaret A. Cargill Foundation and the Anne Ray Charitable Trust. The transaction, which will occur over an eight-month period that began in January 2014, effectively puts the Cargill split-off transaction behind us.

In early 2014 the Mosaic Board of Directors authorized an additional $1 billion share repurchase program, allowing the company to repurchase Class A or common shares, through negotiated direct transactions or in the open market. More than half of this authorization had been executed at the time of publication.

Finally, we reached agreement with our banks to significantly increase our revolving credit facility, providing a substantial liquidity buffer and even more flexibility for future strategic decisions.

- We redoubled our efforts to remain a low-cost producer, with both of our business units and our support functions undertaking efforts to reduce costs and operate more efficiently.

- We changed our fiscal year-end to December 31, from May 31. Calendar reporting better aligns with our business cycle and with our competitors. (Please note that this review discusses calendar 2013; calendar 2014 will be our first full fiscal year on the new reporting schedule.)

- Mosaic continued its support of communities through targeted corporate giving, employee donations and volunteer work. We donated approximately 1 percent of our earnings before interest and taxes for community investments, highlighted by a $1 million commitment to Habitat for Humanity in Saskatchewan and a $400,000 grant to renovate community athletic facilities in Hardee County, Florida.

- Streamsong, our new world-class resort in Central Florida, opened to widespread critical acclaim. The golf operations opened in January 2013, and golfers from around the world have made Streamsong a priority destination. The Lodge and other facilities opened with a celebration in January 2014, and the entire resort is now welcoming guests.

- Finally — and, in my mind, most importantly — we set yet another new record for safety performance in 2013. We achieved a 6 percent improvement in our key safety measure, on the heels of two consecutive record periods. Our first priority is the safety of our employees and communities, and we will continue to strive for an injury-free workplace.

That is quite a record of achievement for one year — and taken together, it represents a bold statement about the future of Mosaic and our industry. Despite the difficult operating environment, we committed major capital and made aggressive decisions to position Mosaic to flourish when — not if — conditions improve.

Mosaic is positioned to emerge, in a stronger business environment, as the world’s leading crop nutrition company.

The Markets: Past, Present and Future

Myriad market forces impact our business, and many of them turned against us in 2013. In North America, despite a late spring and an early fall, farmers harvested a record crop — which bodes well for global food security but less well for short-term grain and oilseed prices. Indeed, future corn prices dropped by nearly half over the course of the year, albeit from record highs following the severe U.S. drought in 2012. A similarly rich harvest in other regions, particularly in Brazil, further weighed on commodity prices.

At the same time, governmental and customer behavior in China and India, two of the world’s most important agricultural countries, continued to have a negative impact on our sales. In China, where agricultural production perennially lags food demand, crop nutrient buyers drew down large inventories and were slow to replenish them. In India, changes to the government’s fertilizer subsidy program skewed the balance of nutrients applied to fields and continued to reverse decades of progress in soil health and farm productivity.

All these conditions caused deeply cautious and risk-averse purchasing behavior by crop nutrient buyers around the world: Our customers bought only what they needed for the immediate future to avoid taking price risk with their inventories.

Despite the difficult environment, Mosaic delivered good earnings in calendar 2013. We generated net sales of $9.0 billion, compared with $10.0 billion in 2012. Net earnings for the year were $1.1 billion, compared with $1.9 billion in 2012.

We expect the business climate to remain challenging in early 2014, particularly in potash, with strong expected volume growth in both nutrients serving as a harbinger of upward price momentum in the latter half of the year.

But the long term — that’s a very different story.

Farmers everywhere will need crop nutrients to achieve sustainable yield growth.

Put simply, economics will win. Increased supply of phosphates, from Saudi Arabia, Morocco and elsewhere, is currently exceeding demand growth, just as increased potash supply, from Mosaic and our competitors, is exceeding current demand — particularly in light of lower grain and oilseed prices.

These are temporary conditions. Over time, Chinese and Indian demand for our products will resume, as farmers there push to meet the food demand of the world’s two most populous countries. In fact, demand for food all around the globe will continue its relentless rise, and, as it does, farmers everywhere will need crop nutrients to achieve sustainable yield growth.

At Mosaic, our mission has not changed: We are here to help the world grow the food it needs. When times are challenging, such statements can seem grandiose. But the critical and daunting challenge facing the world’s farmers persists, whether corn sells today for $4 or $8 per bushel. Earth’s population is expected to grow by nearly 2 billion people between now and 2050. That’s more than 150,000 new mouths to feed every single day. And the challenge is compounded by the positive trend of increasing human prosperity: The millions of people rising above poverty are demanding better diets, with more protein; and growing meats requires more grain. Good nutrition for 9 billion people requires good nutrition for the world’s croplands — and that, in turn, presents great potential for Mosaic.

Good nutrition for 9 billion people requires good nutrition for the world’s croplands — and that, in turn, presents great potential for Mosaic.

The Road Ahead

Opportunity knocks more often than we realize. When conditions are trying — as they are today for Mosaic, with lower potash and phosphate prices, lower grain and oilseed prices, and governments ignoring the imperative for agricultural growth — these knocks can be misinterpreted as unwelcome demands.

By executing strategic decisions large and small, we have chosen to embrace opportunities to optimize our business portfolio and to further solidify an exceptionally strong financial foundation — so that we can seize the remarkable long-term promise that our business holds, for all our constituents.

We are not finished; we will continue to search — across Mosaic and all around the globe — for ways to make the company stronger and better prepared for the future.

The Mosaic team, 8,900 strong, is energized and committed, and I am deeply grateful for all their talent, efforts and determination. Collectively we are grateful for the abiding relationships — with our customers, suppliers and partners — that drive our success.

And finally, we are thankful to our shareholders for your continued confidence, across the business cycle. We look forward to working with all of you for many prosperous years ahead.

Sincerely,

James T. Prokopanko

President and Chief Executive Officer

March 2014