We employ a multifaceted strategy of co-investing,

acquiring, and building assets to deliver sustainable

distribution growth to our unitholders.

We have a talented team of operations

and commercial managers, diligently

maximizing the proftability of our existing

assets. Since our initial public offering,

we have invested over $1.6 billion in

growth capital, with the majority deployed

on third party acquisitions and dropdowns.

Our access to capital markets supports

DCP Midstream’s execution on escalating

growth opportunities while balancing distributions

to sponsors.

Our Strategy

Partnering with DCP Midstream to Grow the DCP Enterprise.

1Q/06

$0.35 $0.38

2Q/06

$0.41

3Q/06

Condensate

6%

Fee-based

59%

2012 Margin by Contract Type

Percentage of

Proceeds/Liquids

27%

Keep Whole

8%

2012 Margin:

Fee and Hedge Position

Growth Since IPO

Fee-based

59%

Commodity

Hedged

28%

Commodity

Unhedged

13%

4Q/06

$0.43

1Q/07

$0.47 $

2

15

clicks

Third Party

Acquisitions

48%

Dropdowns

42%

Organic

Projects

10%

Business Strategies

Co-Invest:

Maximize opportunities

with DCP Midstream

• Pursue direct investments or third party

acquisitions

• Pursue organic build projects

• Pursue accretive dropdown opportunities

Acquire:

Pursue strategic and accretive

third party acquisitions

• Consolidate and expand existing infrastructure

• Pursue new lines of business and expand

geographic areas

• Acquire assets from third parties

Build:

Capitalize on economically

attractive organic expansion

opportunities

• Expand existing infrastructure

• Develop projects in new areas

4

DCP Midstream Partners

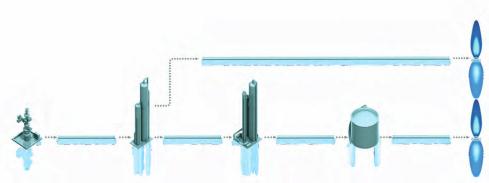

We are a must-run sector that gathers, compresses,

treats, processes, transports, stores, and sells natural

gas, as well as transporting, fractionating, storing and

selling natural gas liquids.

Approximately 75 percent of the country’s natural gas

must be processed after it is produced and before it can

enter the marketplace and serve end-users.

Our three business segments are Natural Gas

Services, Natural Gas Liquids Logistics, and Wholesale

Propane Logistics.

Our Business

The midstream natural gas industry is the link between the exploration and production of natural gas,

and the delivery of its components to end-use markets.

As gas is produced at the wellhead, it is frst gathered and delivered to a centralized

point for processing. The gas processing plant collectively separates the natural

gas liquids (NGLs) — ethane, propane, butane, and other NGLs — from the gas

stream. The processed gas now meets long-haul gas pipeline specifcations and is

transported to end-users. The separated NGLs are transported by NGL pipelines

or trucks to a fractionation facility where the NGLs are further separated into their

constituent parts before transport to end-use markets.

Natural Gas

Transportation Lines/Storage/LNG Facilities

Gas

End-Users

Retailers/End-

Users/Retail

Stations

Terminal/

Storage

Facilities

Transportation

Lines/Rail/Trucks/

Marine Barges/Tankers

NGL/Crude/

Refned Product

Pipelines/Facilities

Fractionation/

Refnery/ Upgrading

Facilities

Mixed Product

and Crude

Pipelines

Gas Processing

Plants

Gas and Crude

Gathering

Wellhead

(Onshore and

Offshore)